When it comes to workers’ compensation fraud red flags, not all instances identified below are signs of insurance fraud. Sometimes it is just a signal to perhaps take a closer look at the claim to verify the claim is legitimate. Sometimes it isn’t just one red flag but a combination of red flags listed below that triggers concern about the legitimacy of a claim.

And while this signals blow could trigger an insurance company to take a closer look at the details of a claim and perhaps investigate further, it may turn out that the claim is completely legitimate.

Let’s get into Workers Compensation Claim Fraudulent Red Flags.

Contents

- 1 The Employee is a Job Hopper

- 2 The Workers Employment Position is Seasonal and Ending Soon

- 3 A Worker Has Been Employed With a Company for a Short Time

- 4 The Employee Had a Long Vacation Before The Claim Was Filed

- 5 An Employee Has Mixed Feelings About Returning to Work

- 6 A Worker Knows There are going to Be Fired

- 7 The Employee is Released to Work by The Doctor and Then Seeks to Find Another Doctor

- 8 The Worker Needs More Time to Recover Then Normal

- 9 The Injured Worker is Malingering

- 10 An Employee is Experiencing Money Issues or Financial Distress

- 11 The Worker Has Filed Similiar Claims in the Past

- 12 There Were No Witnesses to the Accident

- 13 The Injured Individual is Incredibly Active via Their Social Media

- 14 Alleged Injury Happens Shortly After a Vacation

- 15 The Workers Injury Reported on a Monday or Late on a Friday

- 16 Other Employees Are Found Discussing How The Claimant’s Injury is Faked

- 17 A Claimant Seeks Attorney Representation Before There is Any Conflict Regarding The Insurance Claim

- 18 The Claimant is Can Not Be Reached During Business Hours

- 19 Claimant Has a Side Business

- 20 The Injured Worker is Not Interested in Returning to Work Under Light Duty

The Employee is a Job Hopper

This would be a minor red flag but a red flag nonetheless. Employees that have a difficult time staying in a job for extended periods of time could be an indicator that something more is going on in an employee’s life which instigated the insurance claim.

The Workers Employment Position is Seasonal and Ending Soon

Many employers crank up their hiring depending on the season. Landscapers need more employees in the summer months than in the winter months.

Companies like Amazon hire 150,000 employees during the holidays and then lay them off when the season passes.

Employees may not have another job lined up and may have a fabricated injury to continue to receive some financial compensation beyond the time they would have been working for a company.

A Worker Has Been Employed With a Company for a Short Time

For whatever reason, the new employee allegedly gets injured after being employed for a short time with a company. The employee is then off work for an extended period of time.

This isn’t a definite sign of fraud but this is identified as a red flag as similar situations over the years have identified this as a signal that the incident and injury should be investigated to determine if it is a legitimate claim.

The Employee Had a Long Vacation Before The Claim Was Filed

Sometimes employees are just not ready to return to work for whatever reason after a vacation. This doesn’t mean fraud is taking place but it is worth a closer look to see if there is more going on.

An Employee Has Mixed Feelings About Returning to Work

Some folks get legitimately injured on the job however might have become used to being home and taking the kids to school. They might have realized how unhappy they were with the company they are supposed to return to. There may be some malingering to delay their return to work.

A Worker Knows There are going to Be Fired

An employee may have been written up numerous times or have been involved in an incident where they know they are inevitably going to be fired from the company they are working for. A worker allegedly becomes injured before they are terminated from the company.

This may provide some extra time for the employee to find another form of employment.

The Employee is Released to Work by The Doctor and Then Seeks to Find Another Doctor

When a doctor identifies that a patient has fully recovered the doctor will sign off the employee to return to work.

Some employees don’t agree with the doctor’s decision whether correct or not. The employee will seek out another doctor to hear what they want to hear and potentially not return to work.

The Worker Needs More Time to Recover Then Normal

Some legitimate recoveries take longer for some folks than others. However, there may be a variety of reasons that the employee malingers with their claim to prevent coming back to work in a timely manner.

It’s difficult to prove malingering as it relates to recovery time however it is believed that nearly 30 percent of injury claims involve malingering.

The Injured Worker is Malingering

Malingering is an exaggeration of an injury to continue to receive benefits longer or to avoid returning to work. Some signs of malingering include the following:

- The insurance company has a hard time getting ahold of the injured worker.

- The injured employee misses treatments or medical appointments.

- Worker attempts to avoid an Independent Medical Examination (IME).

- Despite a doctor not seeing any reason for the claimant not to return to work, the claimant.

An Employee is Experiencing Money Issues or Financial Distress

There is no clear definitive reason why this red flag is associated with potential fraudulent claims however from an investigator’s point of view there are a few things that have been noticed

The Worker Has Filed Similiar Claims in the Past

This is not necessarily a definitive reason to think someone has a fraudulent claim. However, some individuals could be habitual claim filers.

There Were No Witnesses to the Accident

It’s not uncommon for a workplace accident to happen without witnesses. This could be a signal of concern for an employer or insurance company. Combined with other red flags, it could give an insurance company reason to investigate a claim further.

These types of claims that turn out to be fraudulent have key indicators that reinforce that belief. The claimant will claim other individuals unrelated to the company will have witnessed the accident however the alleged witnesses don’t exist or can never be found.

Many times the accidents happen in locations where the claimant would not normally be which happen to be areas where no one else is working and where there are no surveillance cameras.

Companies more than ever are adding surveillance cameras and other types of surveillance in their business to help protect against fraudulent claims. I have written more about the different types of surveillance if you would like to read about that topic further.

The Injured Individual is Incredibly Active via Their Social Media

Social media accounts of claimants are very revealing as to the activity of someone that claims to be injured. While this information might not be incriminating, it may be the information an insurance company or company needs to initiate an investigation.

Sometimes the social media accounts of the claimant don’t reflect activity but the spouse is the one who shares the activity of the claimant.

There are claimants with injuries that should prevent them from doing activities. If a claimant has a wrist injury but can still play golf, then one would think that they are capable of returning to work. If they can bare the pain during golf, they can bare the pain during work.

Alleged Injury Happens Shortly After a Vacation

Sometimes people get injured while on vacation and not at work. Employees sometimes will come back to work and indicate their injury was a result of something happening at work to make it a work-related injury to get paid while off work and to get their medical treatment paid for.

The Workers Injury Reported on a Monday or Late on a Friday

These sorts of injury claims draw red flags because if an injury is reported on a Monday, many times the worker will say the incident occurred on a Friday before. This in conjunction with other red flags can be a reason to dig into the claim details much further.

Other Employees Are Found Discussing How The Claimant’s Injury is Faked

Sometimes the individual that is involved in making a fraudulent injury claim has discussed their intentions ahead of time with others they work with.

Other times coworkers see the injured worker doing things they allegedly are not capable of doing which will start rumors within the workplace about the injured worker’s claim being illegitimate. This eventually makes its way to management or human resources.

A Claimant Seeks Attorney Representation Before There is Any Conflict Regarding The Insurance Claim

If a claimant lawyers up immediately after an injury, this is a sign that they have been around the block. Most people who are injured at work don’t immediately seek a lawyer unless there is an issue with their claim.

The Claimant is Can Not Be Reached During Business Hours

If a claimant can not be reached during business hours (during the day) this would be concerning to an employer or insurance company. Generally speaking, in these situations where fraud is indeed happening, the claimant needs to find a quiet spot to return the call.

A private investigator was caught doing this while working for an investigation business. While he was not injured, he was actually leaving his work assignments early and fabricating details of the investigation. He would never answer calls, yet return them minutes later. What this investigator in was when the company looked at his business phone records, the towers that were being pinged during calls were nowhere near the area the investigator was supposed to be.

Claimant Has a Side Business

Generally speaking, the reason claimants are found to be hard to get a hold of during business hours which you may have determined from the last section is they have a side job.

This would be double dipping. They are receiving workers’ compensation benefits and a paycheck from their business.

The Injured Worker is Not Interested in Returning to Work Under Light Duty

Many times an employer will have an injured employee return to work doing tasks that fit into the limitation a doctor would set for the claimant.

An example of limitations would be (depending on the injury):

- No standing for longer than 30 minutes at a time

- No running

- No lifting over 20lbs with left arm

It would be suspicious for a claimant to be resistant to returning to work if the tasks fit within the claimant’s restrictions.

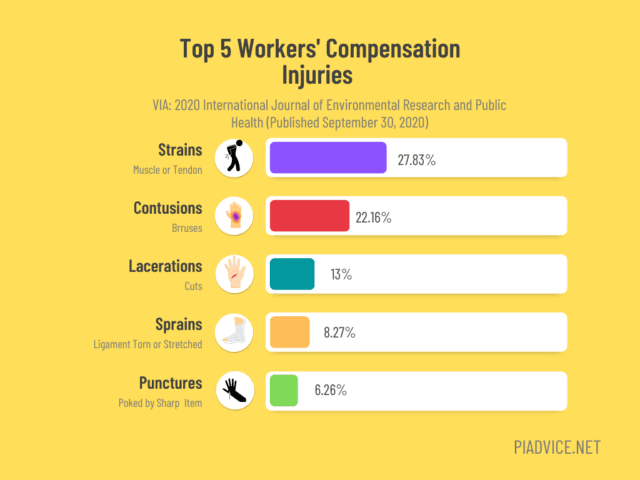

According to study conducted by the International Journal of Environmental Research and Public Health the top 5 Workers’ Compensation Injuries are:

- Strains – 27.83%

- Contusions – 22.16%

- Lacerations – 13%

- Sprains – 8.27%

- Punctures – 6.26%

Some of these injuries are easy to determine if someone is healing properly and some can be more difficult because they are not easily visible. That is why investigating is important to determine if someone is not being truthful about an injury or their recovery.

In a perfect world, a claimant will recover from a workplace injury and return to work. Unfortunately, insurance fraud is something that people will keep trying to get away with and insurance companies will keep investigating claims with the help of insurance investigators.

Humans always have a knack for taking a program designed for good and perverting it for gain.

Of course not every insurance claim is fraudulent of course. When red flags are observed, insurance investigators will investigate and many times conduct surveillance on the claimant.

Recent Posts

Hawaii is probably one of the most interesting states to work as a private investigator if you are not used to the culture or a native of the state. And if you are not a local, that is something...

How to become a private investigator in Georgia