Wondering what is it like to be an insurance investigator? Before we get into that you must first understand some things about the insurance industry. Insurance companies exist to reduce financial uncertainty. In the United States citizens have health insurance, motor vehicle insurance, life insurance, renters insurance, disability insurance, and homeowners insurance. There are more but these are the types of insurance that most people are familiar with.

With all the different types of insurance that exist, it is important that the insurance companies pay claims against the insurance companies that are legitimate and valid. Insurance fraud steals approximately $80 billion every year from consumers in the United States. Insurance investigators are used to locate and gather information for insurance companies so they can make a decision as to whether a claim is valid or not. Insurance investigators act in the same manner as a private investigator would. Insurance investigators work under the same laws as private investigators, use the same resources, and perform the same duties. With that being said, let’s get into the breakdown of duties that an insurance investigator has.

Contents

- 1 Why do Insurance Companies Use Investigators?

- 2 Insurance Investigation Case Intake Happens First

- 3 Insurance Investigators Conduct Preliminary Investigations

- 4 The Insurance Investigator Will the Conduct the Surveillance

- 5 An Insurance Investigator May Be Requested to Appear in Court

- 6 An Insurance Investigator Will Conduct Recorded Interviews

- 7 Insurance Investigators Document Accident Areas

- 8 Specialists May Be Hired in Specific Circumstances

- 9 Is it Dangerous to be an Insurance Investigator?

- 10 What is the Job Outlook for Insurance Investigators?

- 11 Is Being an Insurance Investigator a Good Job to Have?

- 12 What Does it Take to Be a Good Insurance Investigator?

Why do Insurance Companies Use Investigators?

Insurance companies use investigators so they can have a clearer picture of an insurance claim. The insurance companies do not have staff in all areas that they serve so many times they will hire an investigation company that specializes in insurance investigations to be an extension of them.

When it is all said and done, insurance companies want to pay on legitimate insurance claims. Sometimes through an investigation, the insurance company will confirm that the claimant is legitimate.

Other times there are red flags with an insurance company that alerts them to needing more information to pay the claim.

The insurance investigator helps collect the information needed for the insurance company to decide an insurance claim.

With that being said, let’s get into what it is like to be an insurance investigator and the duties involved.

Insurance Investigation Case Intake Happens First

The insurance investigator will receive an assignment from the insurance company that will include but is not limited to information such as:

- The objective of the assignment

- The claimant’s injury or the claimant’s loss (property, life, etc.)

- The claimant’s address

- The claimant provided phone numbers

- Claimant vehicles

- Doctor appointment information (if available)

- Whether the claimant is represented or not

- Any additional notes

- Claimant’s SSN

Insurance Investigators Conduct Preliminary Investigations

If the insurance investigator is assigned to conduct surveillance they will take the provided information and verify it through investigative resources.

New information might be developed through preliminary investigations. This new information could include additional addresses, lawsuits the claimant might be involved in, bankruptcies, additional vehicles, social media accounts, new phone numbers, and more.

If the surveillance assignment is close to the surveillance location, the investigator may conduct a pre-surveillance drive-by of the residence to see the layout of the area and vehicles that may be at the residence. The investigator will attempt to determine a proper surveillance position for future surveillance assignments.

The Insurance Investigator Will the Conduct the Surveillance

The insurance investigator will travel to the surveillance location and find a proper surveillance position. The insurance investigator will document all activities related to the residence and video document any activity of the claimant.

If the claimant departs their residence the insurance investigator will follow the claimant and video document the claimant’s activities in a legal and safe manner.

Surveillance efforts may include following a claimant into a store or restaurant to document their activities. This documentation is obtained generally speaking by a covert video camera.

A surveillance day for an insurance investigator will typically end at the 8-hour mark of the claimant is home and is not in view unless the investigator has information that indicates the claimant will be active again. If the claimant continues to be active past the 8-hour mark, generally speaking, the investigator will continue to document the claimant’s activities until they return to their home and enter out of view of the investigator.

The investigator may return to the residence on another day depending on the number of surveillance days that are requested by the insurance company.

Each day the surveillance is completed, the insurance company will be updated by a surveillance note or by a case manager as to what was documented and any activity noted by the investigator.

At the completion of the surveillance budget, the investigator will have reports detailing each day of surveillance completed. The video documentation of each surveillance day will also be provided to the insurance company.

Additional surveillance efforts may be requested by the insurance company depending on the findings of the investigator.

An Insurance Investigator May Be Requested to Appear in Court

Depending on the outcome of the insurance claim, the investigator may be asked to testify in court regarding the documentation that was obtained during the surveillance period. This time could come months or even years after the investigator conducted surveillance on the assignment.

Prior to the court appearance, the investigator will receive all reports written by that investigator and the video recordings obtained by the investigator to refresh their memory of the surveillance assignment.

An Insurance Investigator Will Conduct Recorded Interviews

There are times when an insurance company will need additional information for a claimant regarding their insurance claim.

Insurance investigators will contact the claimant and arrange for an in-person meeting in most cases to conduct the interview.

The investigator will meet with the claimant and ask questions regarding their health history (for disability, workers compensation claims) as well as details surrounding their claim.

Insurance investigators also conduct recorded statements of witnesses or individuals that have information surrounding the claim made by a claimant.

Insurance investigators may be asked to conduct recorded interviews of claimants related to fires, home thefts, property damage, and the death of a spouse.

In cases where a home had been burglarized, investigators may interview the homeowners, people living at the residence, and neighbors. Generally speaking, insurance investigators will review the list of stolen items and verify value and purchase location as well as the date of purchase.

Insurance Investigators Document Accident Areas

Insurance investigators can also be asked to document an area where an accident took place. This could be related to a vehicle accident, or where someone had a slip and fall. Obtaining photos, video, measurements, and even securing nearby surveillance footage may be conducted by the insurance investigator.

Specialists May Be Hired in Specific Circumstances

There are investigators that specialize in certain areas of investigation like accident reconstruction and arson investigations. They may be called to provide additional clarity to an insurance claim to possibly support or dispute a claim.

Is it Dangerous to be an Insurance Investigator?

It can be dangerous to work as an insurance investigator. There are times when individuals will attempt to attack or harm an insurance investigator during the course of investigative work. The instances may be situational and relatively rare for most investigators however they do happen. To read more about the dangers of being a private investigator I have written in detail about it here.

Insurance investigators may work in dangerous areas during investigations. Even upscale areas or neighborhoods can have some dangerous elements.

If you would like to read and listen to a story about a dangerous surveillance assignment, I have written about it here.

What is the Job Outlook for Insurance Investigators?

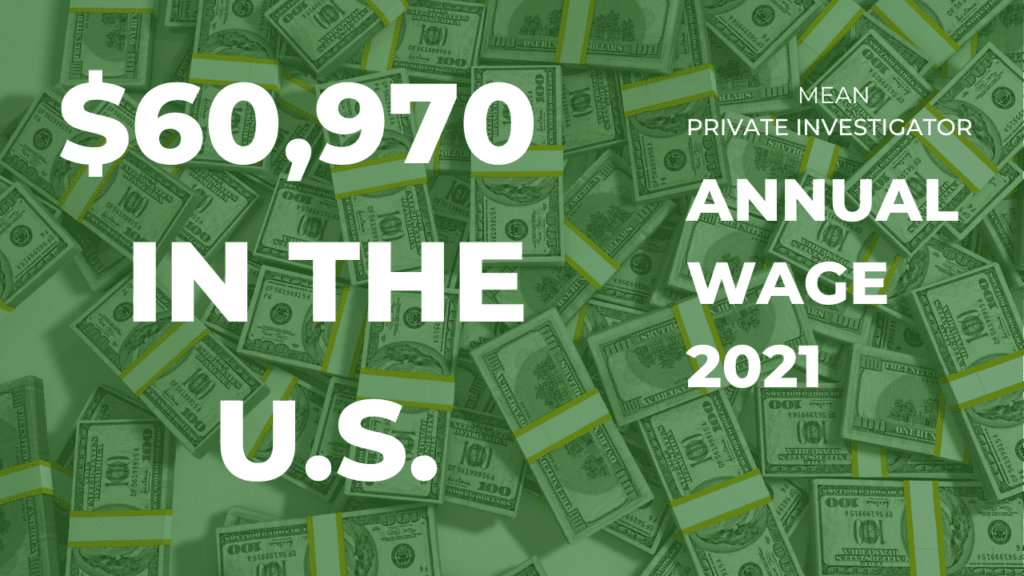

An insurance investigator fits into the job outlook areas as a private investigator would to some degree. With fraud always being a part of society, there will always be a need for insurance investigators.

There will be employment growth within the investigation occupation according to the Bureau of Labor and Statistics.

The average salary depending on where an insurance investigator works can vary from approximately $32,000 a year to $98,000 a year.

For a more complete view of what type of salary an insurance investigator can make I would refer you to another article related to the private investigator salary guide.

Entering the investigation agency through an investigation company that specializes in insurance investigations is easier in many cases than entering through a private investigation company that does not. Generally speaking, many large insurance investigation companies are open to training investigators and in some cases, providing equipment.

Is Being an Insurance Investigator a Good Job to Have?

Being an insurance investigator carries the same pros and cons as being a private investigator. So there will be inconsistent pay, inconsistent workloads, possible danger, you will work alone the majority of the time and there will be days where you never know when a surveillance investigation will end.

Of course, it is very gratifying to discover insurance fraud through the course of an investigation or a surveillance assignment. In that sense, it is very fulfilling when that does occur.

What Does it Take to Be a Good Insurance Investigator?

To be a good insurance investigator, following what makes a good private investigator is the key to success. If you would like to read more about that I have written about that here.

Generally speaking, you will need the following traits:

- Inquisitive

- Persistent

- Objective

- Honest

- Have Integrity

- Good Writing Skills

- Able to Type

- You Are Likeable

- A Good Communicator

- Able to Act a Little

- Good Communication Skills

- Trainable

I hope this gives you an idea of what it is like to be an insurance investigator. Being an insurance investigator can lead to many other career paths should you decide to build upon that career.

Recent Posts

Hawaii is probably one of the most interesting states to work as a private investigator if you are not used to the culture or a native of the state. And if you are not a local, that is something...

How to become a private investigator in Georgia